Foreign Companies Coming to Canada

Canada was rated by Forbes as the best country in America and the second-best country in the G20 with which to do business. Offering a strong business environment for innovation, as well as a transparent and immigration regime, Canada is an attractive destination for foreign businesses and entrepreneurs considering an international expansion.

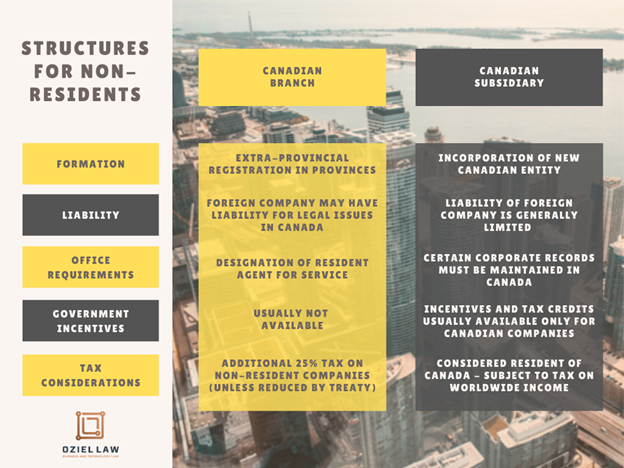

When entering the Canadian market, there are many factors you should consider, such as tax rates, legal liability and ability to access government programs. If you would also like to live in Canada, there are immigration considerations that should factor into your decision. All these factors will depend on how you go about structuring your business.

Canadian Branch or Canadian Subsidiary

The main forms of businesses in Canada are the following:

- Corporation

- Sole proprietorship

- Unlimited liability company

- Partnership

- Cooperative

- Trust

- Branch of a foreign corporation

If your foreign company is expanding to Canada, the most common options are operating via a branch or incorporating a Canadian subsidiary.

The branch is essentially an extension of the foreign company business. When a branch is chosen, the foreign company must extra-provincially register in all Canadian provinces where it plans to carry on business. Your foreign company will also need to appoint an agent for service that is resident in Canada.

The subsidiary, on the other hand, is a separate Canadian corporation, which is controlled by the foreign company. If a Canadian subsidiary is chosen, you should also consider the costs of incorporating the new Canadian entity and the annual expenses for its maintenance. As an example, every year you will need to prepare and file corporate returns, financial statements and income tax returns in Canada. In addition, you will have to determine if there are individuals resident in Canada who are available to serve as directors of the new Canadian corporation, since most jurisdictions in Canada have minimum Canadian residency requirements for directors. One exception to this is British Columbia, which does not have this requirement and, for this reason, may be an attractive province for foreign investors to incorporate their Canadian subsidiary.

There are also important considerations regarding the liability of the foreign company, tax implications and access to government incentives in Canada. Usually, prior to proceeding with the Canadian operations, it is recommended that you obtain foreign legal and tax advice.

Ownership Structure and Immigration Considerations

If you are planning to live in Canada, you should also consider the immigration options available for foreign entrepreneurs and workers. Some of these options allow you to come to Canada under a work permit, such as an Intra-Company Transfer or an Owner/Operator Labour Market Impact Assessment (LMIA). Canada also has a Startup Visa Program, which may be used by foreign entrepreneurs to obtain permanent resident status.

The structure of the new Canadian entity and its relationship to the foreign company can influence your work permit and PR options. Getting advice from an immigration lawyer regarding your immigration options is usually recommending in this case.